Sea freight

One stop shop for International Shipping

Expertise and experience in clearance of various commodities from plastics to machinery over 4 decades.

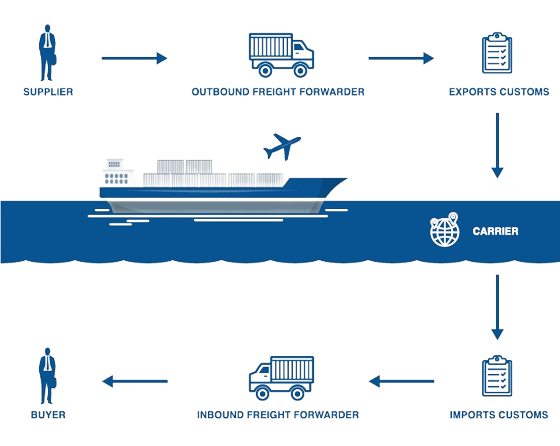

Globally known for our ability to handle every last detail of our customers’ particular logistics and forwarding needs, Navbharatshipping’s Special Services team takes care of all your logistics.

For over 40 years, we’ve been an industry-wide name as Customs House Agent (CHA) & Freight Forwarder. We have a nationwide network of branches and warehouses. Also we have thriving and growing network of agents across the world to ensure timely and hassle-free shipment of your goods.

We have agents across the globe handling various commodities. Integration with our Customs Clearance business gives us the ability to provide a seamless experience to our customers.

With an ever-growing and loyal clientele base, we have worked with goods ranging from plastics to optical lenses, from textiles to industrial products, machinery to chemicals, metal ores to steel scrap and many more.

Over the last three decades, we have expanded our services from Customs Clearance to end-to-end Logistics Service Provider. We provide efficient and economical logistics services at International standards to ensure an effortless experience for you.

Commodities

Shipments

Clients

Countries

We are reliable and customer centric. Our aim is to provide best services to our Clients.